NCOSS One-Stop-Shop Setup

NCOSS One-Stop-Shop Setup

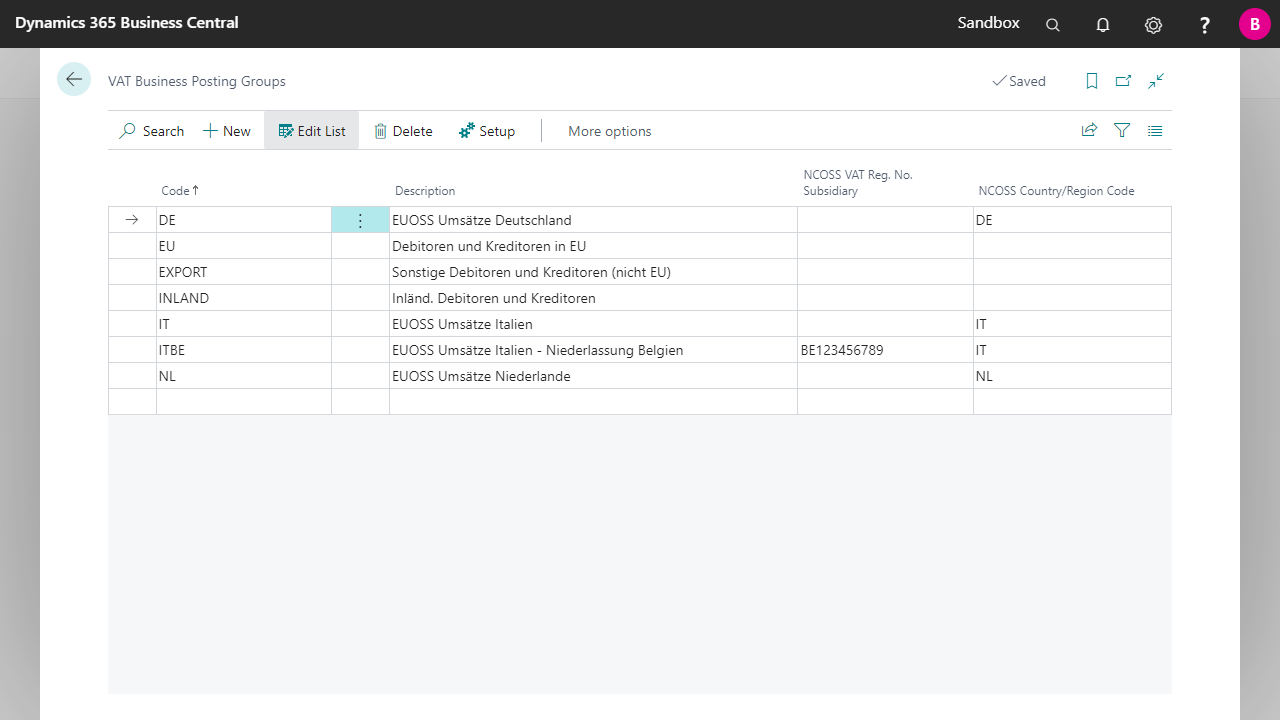

| NCOSS VAT Reg. No. Subsidiary | This field only needs to be filled if there are sales made from a different VAT registration number than the VAT registration number of the company. For these a separate VAT Business Posting Group must be created for this subsidiary. The VAT registration number of the subsidiary has to be entered in the field. This allows to report sales of branches also with their own VAT registration number.

|

| NCOSS Country/Region Code | Specifies the ISO Country Code for which the EU One-Stop-Shop Statement is to be made.

|

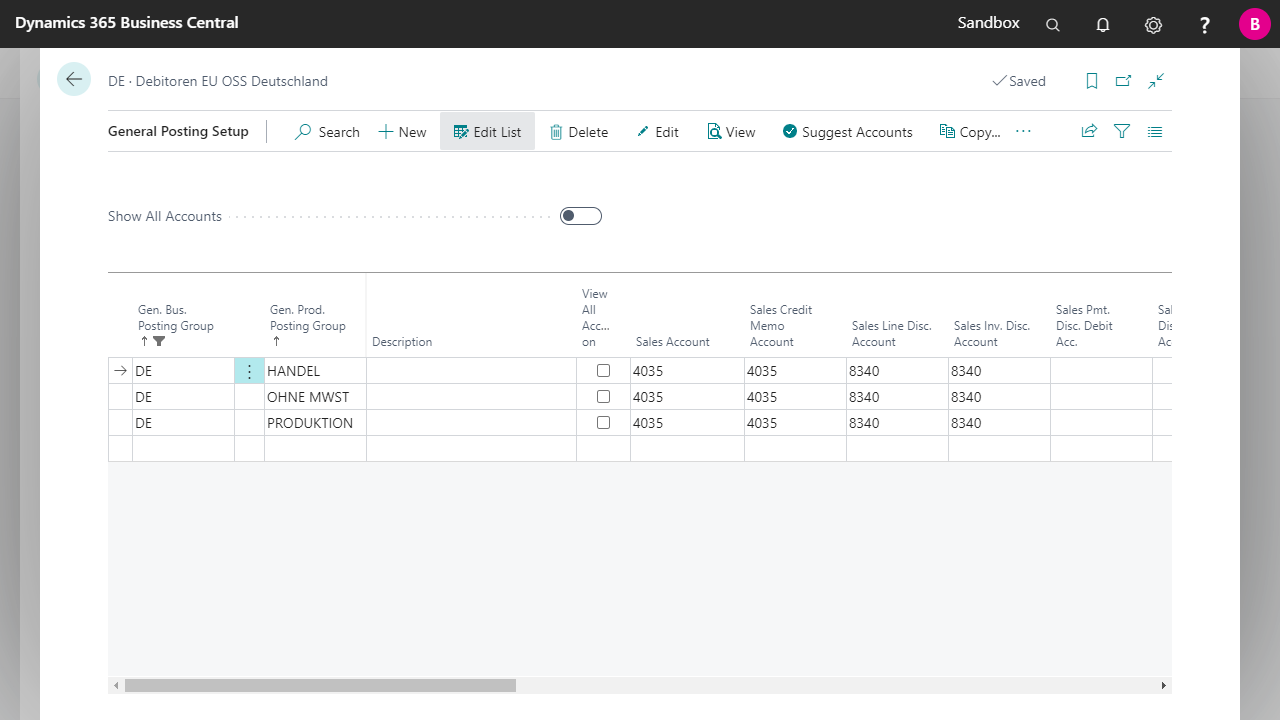

This configuration is only necessary for sales, so the purchase accounts can remain empty.

This configuration is only necessary for sales, so the purchase accounts can remain empty.

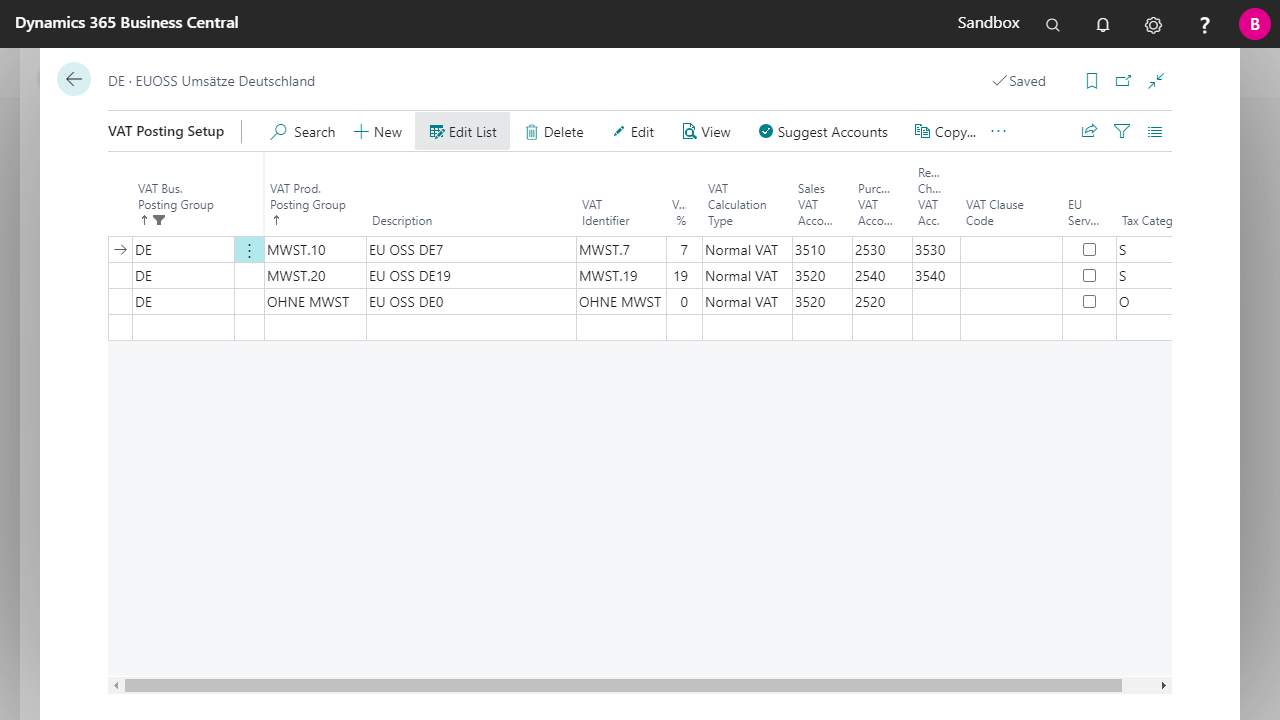

The VAT Rates of the individual EU countries can be retrieved from the following link:

Mehrwertsteuersätze in der EU - WKÖ

The VAT Rates of the individual EU countries can be retrieved from the following link:

Mehrwertsteuersätze in der EU - WKÖ

| FinanzOnline VAT Reg. No. Validation VAT Reg. No. validation via the Austrian FinanzOnline (FON) service. More information  |