Working with NCOSS One-Stop-Shop

Working with NCOSS One-Stop-Shop

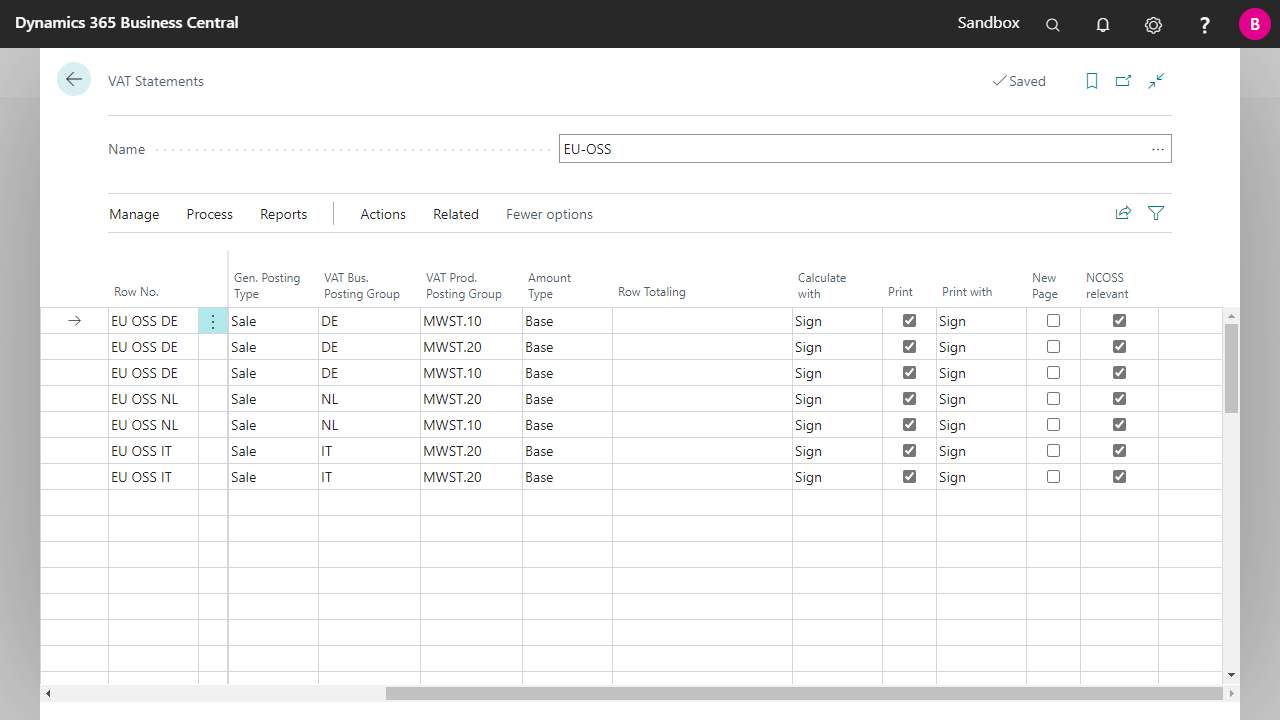

To create the EU-OSS VAT Statement, set up the required combinations of VAT Business Posting Group and VAT Product Posting Group in the VAT Statement with the posting type Sales and the amount type Base.

To create the EU-OSS VAT Statement, set up the required combinations of VAT Business Posting Group and VAT Product Posting Group in the VAT Statement with the posting type Sales and the amount type Base.

| NCOSS relevant | Specifies whether to create an XML line for the EU OSS VAT Statement. |

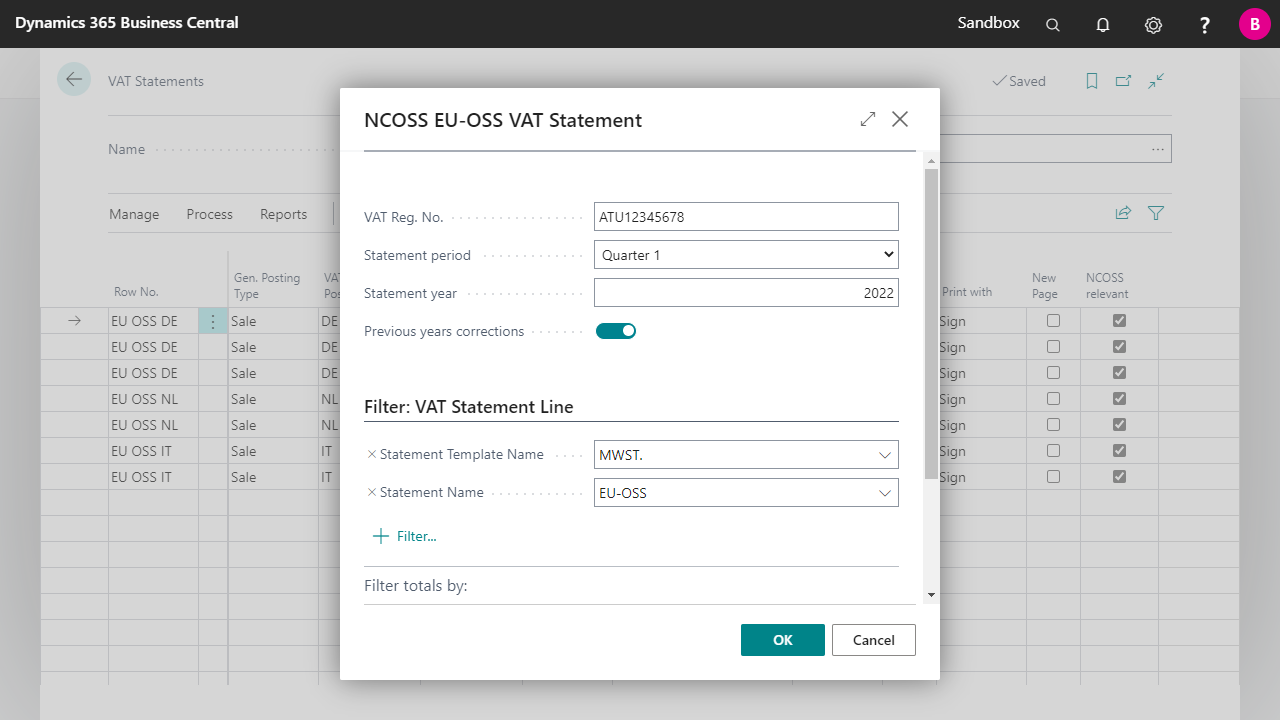

| VAT Reg. No. | The field VAT Reg. No.. is automatically pre-filled from the Company Information table. |

| Statement period | In the field Statement period must be selected the quarter for which the statement should be created. |

| Statement Year | In the field Statement Year, the year for which the statement is to be created must be entered. |

| Corrections from previous periods | The field Corrections from previous periods can only be used if the report Calculate and Post VAT Settlement is started after the statement. If the job is not run this field must be set inactive. This field reports all the VAT entries that have not been closed from the periods that precede the reporting period. |

| FinanzOnline VAT Reg. No. Validation VAT Reg. No. validation via the Austrian FinanzOnline (FON) service. More information  |