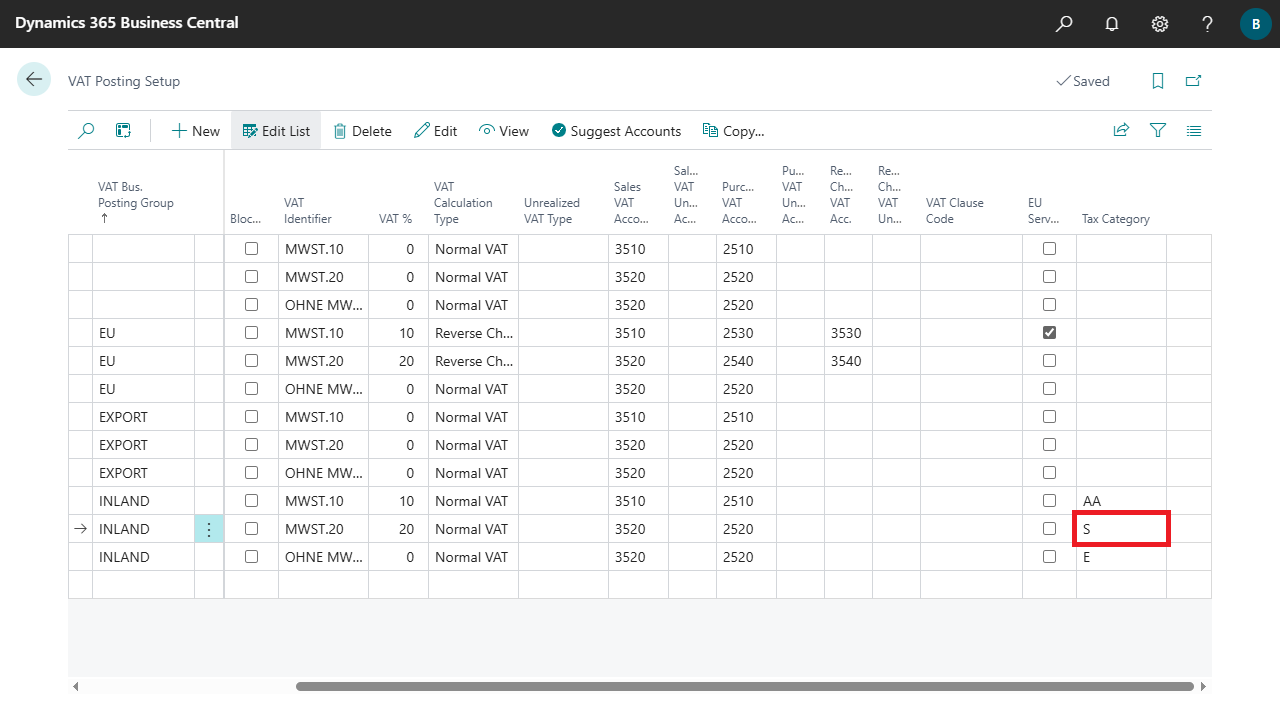

VAT Posting Setup

VAT Posting Setup

| Tax Category | Specifies the VAT category in connection with electronic document sending.

The values are based on UN/CEFACT code list 5305, version D16B.

For more information, see https://unece.org/fileadmin/DAM/trade/untdid/d16b/tred/tred5305.htm

|